Pure Storage, Inc. has revealed its financial performance for the fiscal fourth quarter and the full year of 2025, concluding on February 2, 2025. CEO Charles Giancarlo highlighted the company’s commitment to transforming data storage and management for enterprises and hyperscalers alike.

Financial Overview

“Pure Storage delivered solid fourth quarter and full year results as we fundamentally transform data storage and management for enterprises and hyperscalers,” stated Giancarlo. He emphasized that the company is facilitating the modernization of outdated storage setups into enterprise data clouds with the introduction of Fusion, a pivotal advancement in their offerings.

Key Financial Highlights

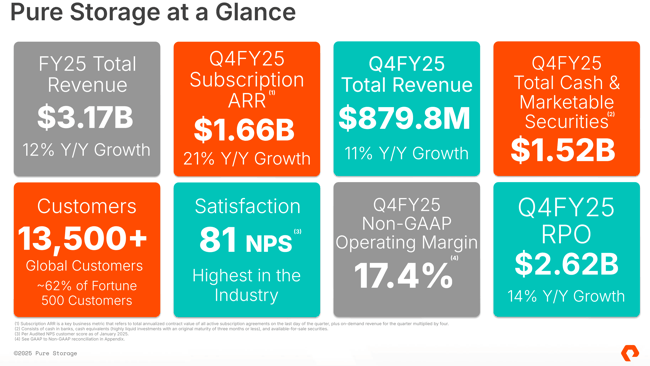

- Q4 revenue reached $879.8 million, marking an 11% increase year-over-year.

- Full-year revenue totaled $3.2 billion, a 12% uptick compared to the previous year.

- Q4 subscription services revenue hit $385.1 million, up 17% year-over-year.

- Full-year subscription services revenue stood at $1.5 billion, reflecting a 22% increase year-over-year.

- Q4 subscription annual recurring revenue (ARR) amounted to $1.7 billion, which is a 21% growth year-over-year.

- Remaining performance obligations (RPO) were reported at $2.6 billion, a 14% increase year-over-year.

- Q4 GAAP gross margin was 67.5%, with a non-GAAP gross margin of 69.2%.

- Full-year GAAP gross margin reached 69.8%, and non-GAAP gross margin was 71.8%.

- Q4 GAAP operating income registered at $42.5 million, with a non-GAAP operating income of $153.1 million.

- Full-year GAAP operating income totaled $85.3 million, and non-GAAP operating income was $559.4 million.

- Q4 GAAP operating margin stood at 4.8%, and non-GAAP operating margin was reported at 17.4%.

- Operating cash flow for Q4 was $208.0 million, with free cash flow at $151.9 million.

- For the full year, operating cash flow reached $753.1 million, and free cash flow was $526.4 million.

- Total cash, cash equivalents, and marketable securities amounted to $1.5 billion.

- $192 million was returned to stockholders in Q4 through share repurchases of 3.1 million shares, and $374 million was returned for the full year with 6.7 million shares repurchased.

- An authorization for an additional $250 million in share repurchases under its stock repurchase plan was established.

“We achieved a major financial milestone in fiscal year 2025, surpassing $3 billion in total revenue for the first time while delivering strong operating profit,” stated CFO Kevan Krysler. He noted that this year was characterized by significant innovation and sets the foundation for sustained long-term growth.

Company Highlights

- Hyperscale Progress: The company secured a design win with a leading hyperscaler, introducing Pure’s DirectFlash software into large-scale settings traditionally reliant on HDDs. A partnership with Kioxia and expanded collaboration with Micron Technology was also announced.

- Platform Innovation: Pure released Pure Fusion v2, allowing customers to manage storage environments akin to enterprise data clouds. Enhancements to the Pure/IE family were introduced, promoting better cost-effectiveness and efficiency while displacing traditional disk technologies.

- Enterprise AI Adoption: Certification of FlashBlade//S500 with NVIDIA OGX SuperPOD was achieved, optimizing AI training environments. A full-stack GenAI solution was launched to support enterprise AI initiatives.

- Strengthening Partner Ecosystem: A revamped Reseller Partner Program was rolled out to enhance profitability and provide partners with greater operational autonomy.

Industry Recognition

- Pure Storage was recognized as a leader for the eleventh consecutive year in the Gartner Magic Quadrant for Primary Storage Platforms.

- The company achieved a world-class Net Promoter Score (NPS) of 81, reflecting consistent customer satisfaction throughout its expansion.

- Pure Storage was listed among Forbes’ Most Trusted Companies in America 2025 and Fortune’s Best Places to Work in Technology 2024.

- It was acknowledged by the Science Based Targets Initiative (SBTi) for aligning its greenhouse gas emissions reduction targets with a 1.5°C trajectory.

Guidance for FY26

As the company looks forward, management has provided financial guidance for the first quarter and fiscal year 2026, cautioning that actual results could deviate from projections due to various factors beyond its control.

Stock Repurchase Authorization: Pure’s audit committee has approved an additional $250 million in share repurchases, which will be executed at management’s discretion using available working capital. The program does not have a set expiration and can be halted or resumed at any time without prior notice.

Resources for Further Information:

Earnings Release, Earnings Presentation, and Prepared Remarks are accessible for detailed financial insights.