Rubrik, Inc. has released its financial performance metrics for the fourth quarter and the entire fiscal year of 2025, which concluded on January 31, 2025. The results showcase notable growth across multiple key areas.

Fourth Quarter Financial Performance

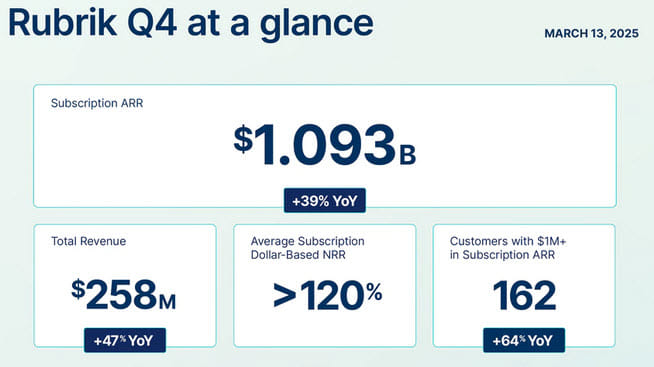

- Annual Recurring Revenue (ARR): Subscription ARR surged by 39% year-over-year, reaching $1,092.6 million.

- Total Revenue: The company’s total revenue hit $258.1 million, marking a 47% increase from the previous year.

- Subscription Revenue: This sector saw a 54% growth, amounting to $243.7 million.

- Customer Base: The number of customers contributing $100,000 or more in Subscription ARR increased by 29% year-over-year, totaling 2,246 customers.

- Gross Margin: The GAAP gross margin stood at 77.4%, a slight improvement over last year, while the non-GAAP margin was reported at 79.7%.

- Net Loss: The GAAP net loss per share decreased to $(0.61) from $(1.59) year-over-year.

- Cash Flow: Operations generated $83.6 million in cash flow, a significant increase from $12.8 million in the prior year.

Full Fiscal Year 2025 Overview

- Total Fiscal Revenue: Annual revenue reached $886.5 million, reflecting a 41% year-over-year increase.

- Subscription Revenue Growth: Annual subscription revenue was $828.7 million, up 54% from $537.9 million in fiscal 2024.

- Gross Margin: The GAAP gross margin for the year was recorded at 70.0%, while the non-GAAP margin was 78.0%.

- Net Loss per Share: The GAAP net loss per share for the fiscal year was $(7.48), compared to $(5.84) in the previous year.

Management Insights

Bipul Sinha, CEO, emphasized the company’s success in the cyber resilience domain, highlighting that fiscal 2025 marked significant progress for Rubrik. CFO Kiran Choudary also remarked on the positive operating leverage and achievement of the first year’s positive free cash flow, underscoring commitment to capitalize on growth opportunities in fiscal 2026 and beyond.

Recent Developments

- Introduced Rubrik Annapurna, aimed at expediting the development of GenAI applications.

- Rubrik Security Cloud – Government received FedRAMP authorization at the Moderate Impact Level.

- Combined Data Security Posture Management (DSPM) with Cyber Recovery capabilities within a unified platform.

- Launched Turbo Threat Hunting to enhance cyber recovery efforts, enabling rapid scanning of large backup volumes.

- Included in CRN’s 2025 Cloud 100 List, recognizing excellence in cloud storage solutions.

Future Outlook

- First Quarter Fiscal 2026 Projection:

- Revenue anticipated between $259 million and $261 million.

- Non-GAAP Subscription ARR contribution margin expected at 4.0% to 5.0%.

- Non-GAAP EPS projected to range from $(0.33) to $(0.31).

- Full Year 2026 Projections:

- Subscription ARR expected to fall between $1,350 million and $1,360 million.

- Total revenue forecasted to be $1,145 million to $1,161 million.

- Non-GAAP EPS projected between $(1.23) and $(1.13).

- Free cash flow anticipated to be $45 million to $65 million.

For further details and comprehensive financial data, stakeholders may refer to the official investor presentation released by Rubrik.